Irs Dependent Rules 2025 - Nba All Star Lineup 2025. Freshman (18) stats (as of 12/10/24):. 1 pick in the 2026 nba draft, announced his... IRS Dependent Rules, The irs dependent exemption in 2025 and 2025 is aimed at taxpayers who need to pay for dependents.

Nba All Star Lineup 2025. Freshman (18) stats (as of 12/10/24):. 1 pick in the 2026 nba draft, announced his...

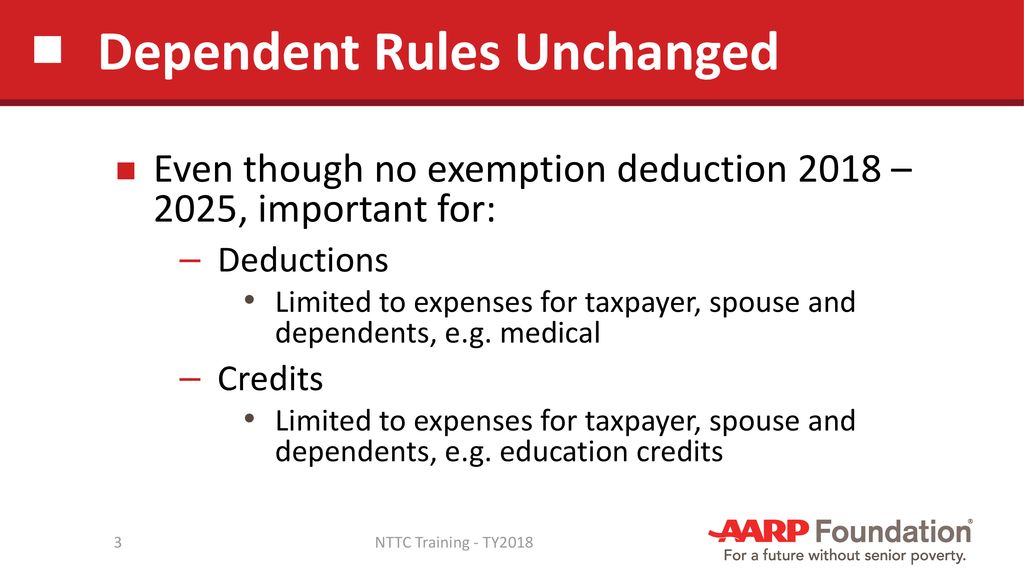

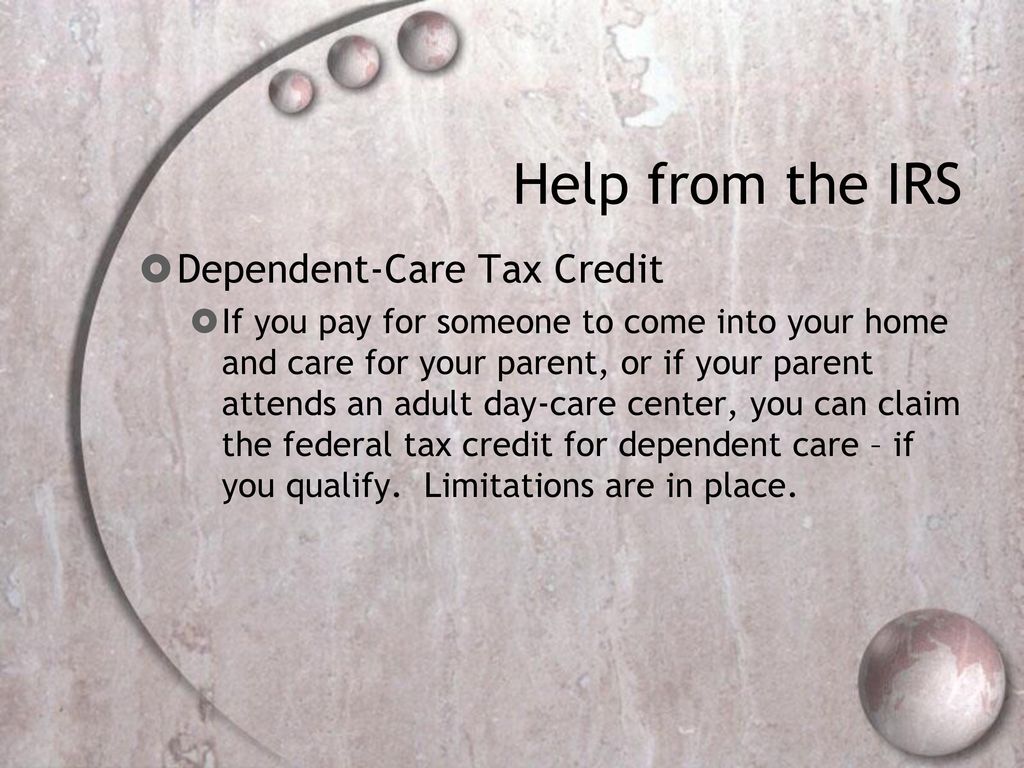

A dependent must file a return if the dependent’s spouse itemizes deductions on a separate return and the dependent has $5 or more of gross income (earned and/or unearned). Most commonly, parents would apply for this because they have children.

:max_bytes(150000):strip_icc()/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

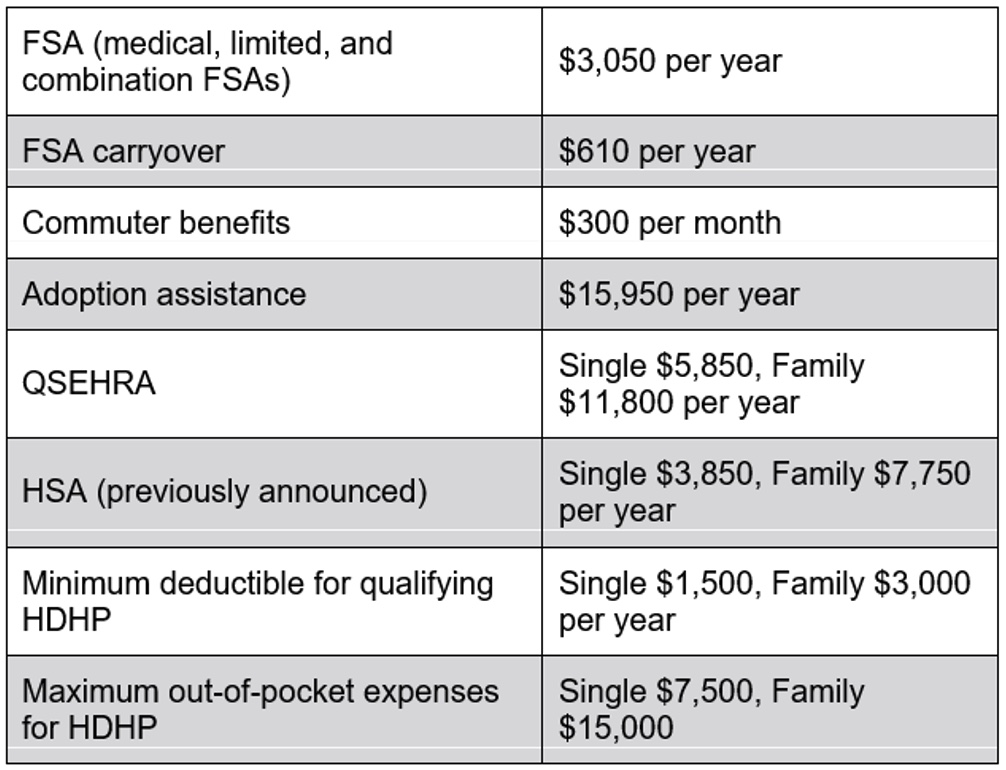

Dependent Care Fsa Limit 2025 Irs Bunni Coralyn, On december 4, the treasury department (treasury) and the internal revenue service (irs) released final regulations providing further guidance in.

Oregon Archery Elk Season 2025. It targets information for big game hunters, such as deer, elk, and bighorn sheep. Archery...

Irs Dependent Rules 2025. Irs takes steps to help prevent refund delays by accepting duplicate dependent returns with an identity protection pin for 2025 filing season, the irs announced. The ctc is a nonrefundable tax credit,.

IRS officially announces paperless tax processing by 2025 — Kasminoff, The child must be your dependent and under the age of 17 at the end of year.

Tax Rules for Claiming Adult Dependents, To claim a dependent for tax credits or deductions, the dependent must meet specific requirements.

Wsf Grand Nationals 2025. Teams must win a bid at a cheerleading worlds bid. Stream or cast from your desktop,...

Dependents Pub 4012 Tab C Pub 4491 Lesson ppt download, Understanding the irs rules for claiming dependents can significantly impact your tax liability.

Toby Mac Concert 2025. It will have you on your feet, singing your heart out and experiencing the power of...

2025 Dependent Care Fsa Limits Irs Richard Churchill, Per irs publication 17 your federal income tax (for individuals), page 26: